The hardware and bandwidth for this mirror is donated by dogado GmbH, the Webhosting and Full Service-Cloud Provider. Check out our Wordpress Tutorial.

If you wish to report a bug, or if you are interested in having us mirror your free-software or open-source project, please feel free to contact us at mirror[@]dogado.de.

ustyc US Treasury Yield CurveThe main function in this R package forms a query to submit for US

Treasury yield curve data, posting this query to the US Treasury web

site’s data feed service. By default the download includes data yield

data for 12 products from January 1, 1990, some of which are NA during

this span. The caller can pass parameters to limit the query to a

certain year or year and month, but the full download is not especially

large. The download data from the service is in XML format. This

function transforms that data into a numeric data frame with treasury

product items (constant maturity yields for 12 kinds of bills, notes,

and bonds) as columns and dates as row names. The function returns a

list which includes an item for this data frame as well as query-related

values for reference and the update date from the service. The data

frame can be used as-is or converted easily to a time series format such

as xts.

require(ustyc)

yc <- getYieldCurve()

summary(yc)

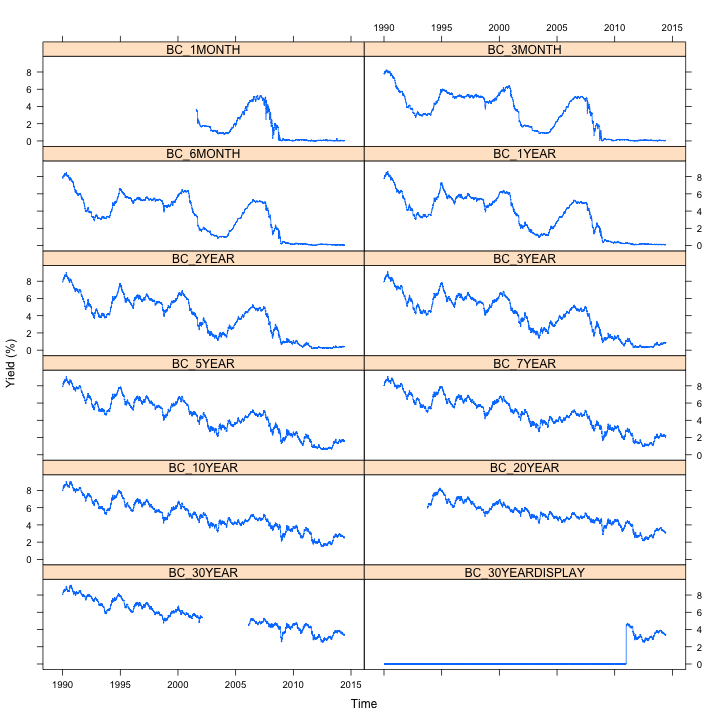

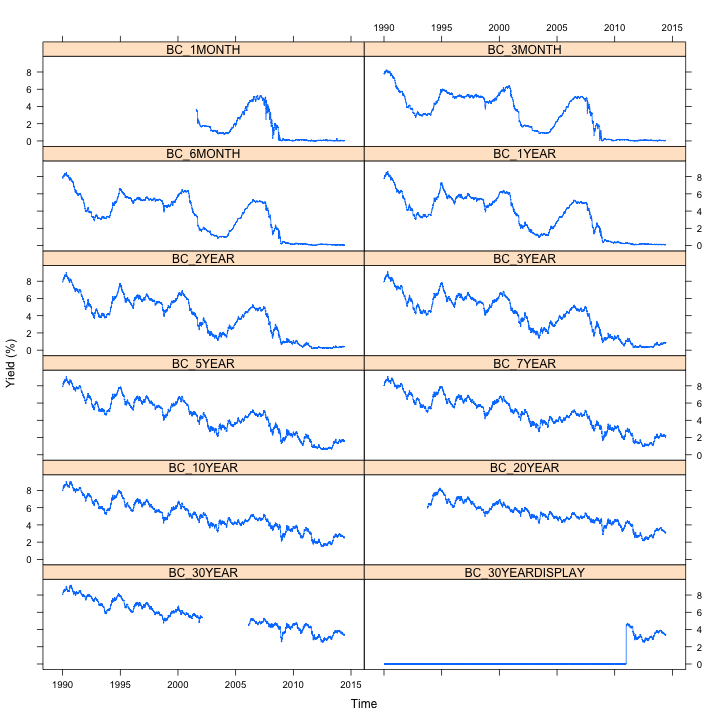

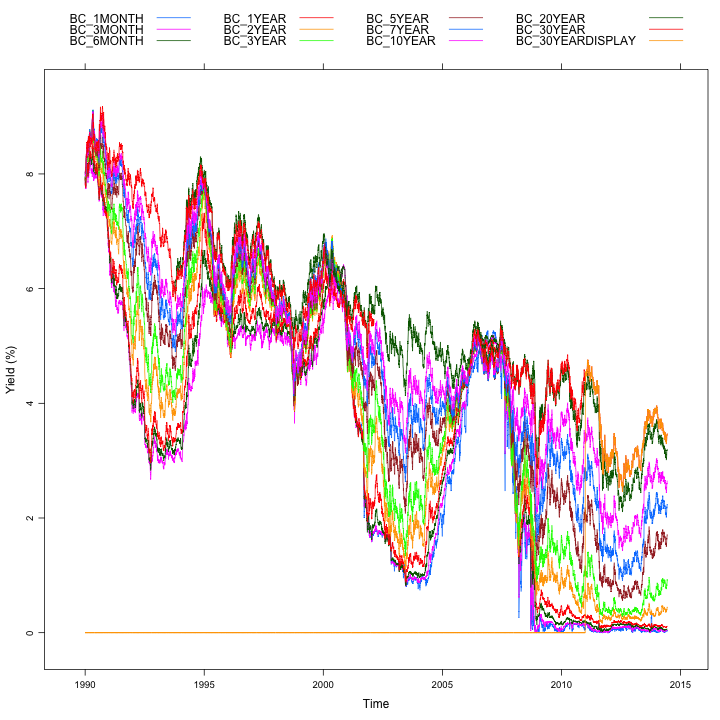

head(yc$df)The data frame might be converted to xts and plotted for

example with lattice:

require(xts)

require(lattice)

xt = xts(yc$df,order.by=as.Date(rownames(yc$df)))

xyplot.ts(xt,scales=list(y=list(relation="same")),ylab="Yield (%)")

xyplot.ts(xt,superpose=TRUE,auto.key=list(columns=4),ylab="Yield (%)")

See the package vignette for examples of these plots.

References: * US Treasury Feed Service

These binaries (installable software) and packages are in development.

They may not be fully stable and should be used with caution. We make no claims about them.

Health stats visible at Monitor.