The hardware and bandwidth for this mirror is donated by dogado GmbH, the Webhosting and Full Service-Cloud Provider. Check out our Wordpress Tutorial.

If you wish to report a bug, or if you are interested in having us mirror your free-software or open-source project, please feel free to contact us at mirror[@]dogado.de.

Automated backtesting of multiple portfolios over multiple datasets of stock prices in a rolling-window fashion. Intended for researchers and practitioners to backtest a set of different portfolios, as well as by a course instructor to assess the students in their portfolio design in a fully automated and convenient manner, with results conveniently formatted in tables and plots. Each portfolio design is easily defined as a function that takes as input a window of the stock prices and outputs the portfolio weights. Multiple portfolios can be easily specified as a list of functions or as files in a folder. Multiple datasets can be conveniently extracted randomly from different markets, different time periods, and different subsets of the stock universe. The results can be later assessed and ranked with tables based on a number of performance criteria (e.g., expected return, volatility, Sharpe ratio, drawdown, turnover rate, return on investment, computational time, etc.), as well as plotted in a number of ways with nice barplots and boxplots.

The package can be installed from CRAN or GitHub:

# install stable version from CRAN

install.packages("portfolioBacktest")

# install development version from GitHub

devtools::install_github("dppalomar/portfolioBacktest")To get help:

library(portfolioBacktest)

help(package = "portfolioBacktest")

?portfolioBacktestTo cite portfolioBacktest in publications:

citation("portfolioBacktest")Do the backtest on your own portfolio following few steps:

library(portfolioBacktest)

data("dataset10")my_portfolio <- function(dataset, w_current) {

prices <- dataset$adjusted

N <- ncol(prices)

return(rep(1/N, N))

}bt <- portfolioBacktest(my_portfolio, dataset10)backtestSummary(bt)$performance

#> fun1

#> Sharpe ratio 1.476203e+00

#> max drawdown 8.937890e-02

#> annual return 1.594528e-01

#> annual volatility 1.218623e-01

#> Sortino ratio 2.057677e+00

#> downside deviation 8.351402e-02

#> Sterling ratio 2.122653e+00

#> Omega ratio 1.295090e+00

#> VaR (0.95) 1.101934e-02

#> CVaR (0.95) 1.789425e-02

#> rebalancing period 1.000000e+00

#> turnover 8.641594e-03

#> ROT (bps) 7.334458e+02

#> cpu time 1.230769e-03

#> failure rate 0.000000e+00For a more detailed explanation on how to use the package with all the features, check the vignette.

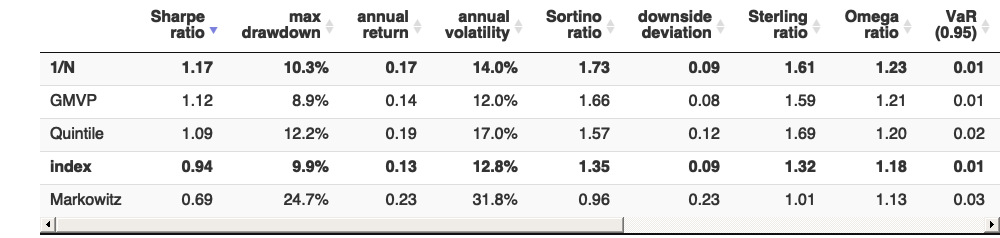

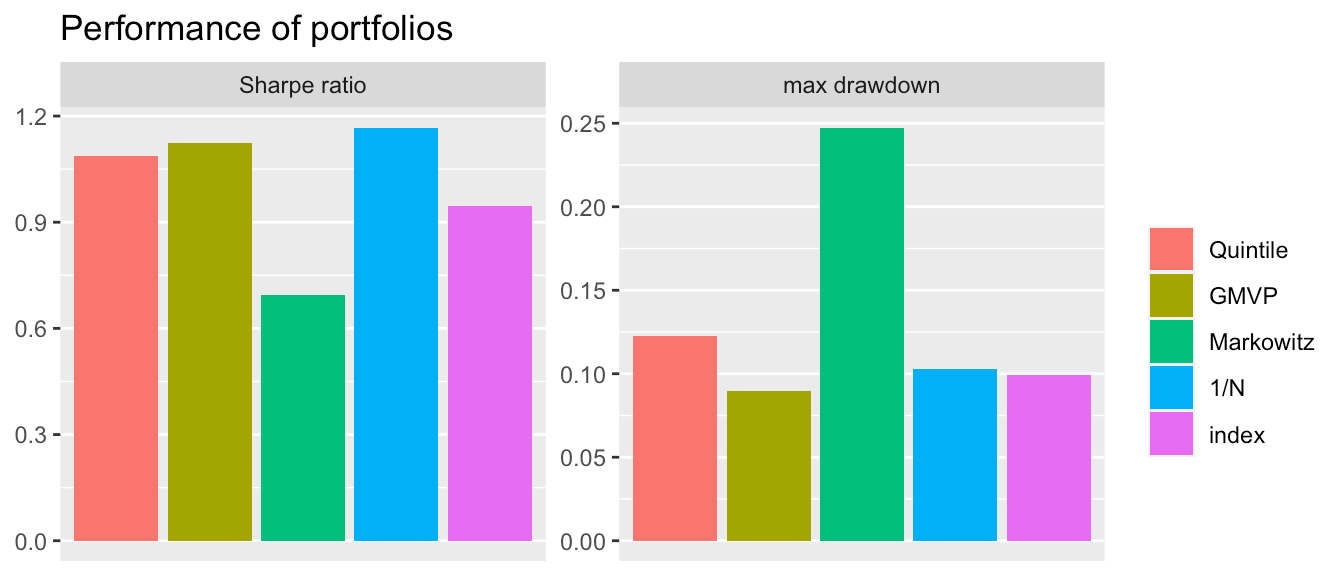

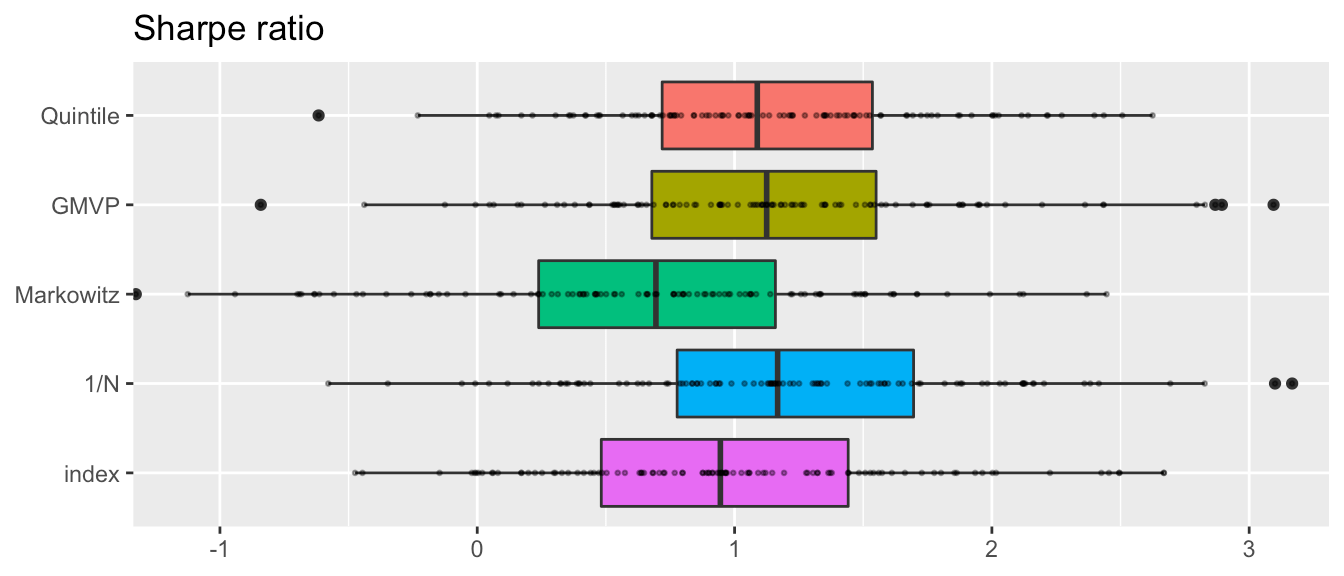

This package backtests a list of portfolios over multiple datasets on a rolling-window basis, producing final results as in the following.

For more detailed information, please check the vignette.

README file: GitHub-readme.

Vignette: CRAN-vignette and GitHub-vignette.

These binaries (installable software) and packages are in development.

They may not be fully stable and should be used with caution. We make no claims about them.

Health stats visible at Monitor.