The hardware and bandwidth for this mirror is donated by dogado GmbH, the Webhosting and Full Service-Cloud Provider. Check out our Wordpress Tutorial.

If you wish to report a bug, or if you are interested in having us mirror your free-software or open-source project, please feel free to contact us at mirror[@]dogado.de.

ARDL creates complex autoregressive distributed lag

(ARDL) models and constructs the underlying unrestricted and restricted

error correction model (ECM) automatically, just by providing the order.

It also performs the bounds-test for cointegration as described in Pesaran

et al. (2001) and provides the multipliers and the cointegrating

equation. The validity and the accuracy of this package have been

verified by successfully replicating the results of Pesaran et

al. (2001) in Natsiopoulos

and Tzeremes (2022).

ARDL?# You can install the released version of ARDL from CRAN:

install.packages("ARDL")

# Or the latest development version from GitHub:

install.packages("devtools")

devtools::install_github("Natsiopoulos/ARDL")This is a basic example which shows how to use the main functions of

the ARDL package.

Assume that we want to model the LRM (logarithm of real

money, M2) as a function of LRY, IBO and

IDE (see ?denmark). The problem is that

applying an OLS regression on non-stationary data would result into a

spurious regression. The estimated parameters would be consistent only

if the series were cointegrated.

library(ARDL)

data(denmark)First, we find the best ARDL specification. We search up to order 5.

models <- auto_ardl(LRM ~ LRY + IBO + IDE, data = denmark, max_order = 5)

# The top 20 models according to the AIC

models$top_orders

#> LRM LRY IBO IDE AIC

#> 1 3 1 3 2 -251.0259

#> 2 3 1 3 3 -250.1144

#> 3 2 2 0 0 -249.6266

#> 4 3 2 3 2 -249.1087

#> 5 3 2 3 3 -248.1858

#> 6 2 2 0 1 -247.7786

#> 7 2 1 0 0 -247.5643

#> 8 2 2 1 1 -246.6885

#> 9 3 3 3 3 -246.3061

#> 10 2 2 1 2 -246.2709

#> 11 2 1 1 1 -245.8736

#> 12 2 2 2 2 -245.7722

#> 13 1 1 0 0 -245.6620

#> 14 2 1 2 2 -245.1712

#> 15 3 1 2 2 -245.0996

#> 16 1 0 0 0 -244.4317

#> 17 1 1 0 1 -243.7702

#> 18 5 5 5 5 -243.3120

#> 19 4 1 3 2 -243.0728

#> 20 4 1 3 3 -242.4378

# The best model was found to be the ARDL(3,1,3,2)

ardl_3132 <- models$best_model

ardl_3132$order

#> LRM LRY IBO IDE

#> 3 1 3 2

summary(ardl_3132)

#>

#> Time series regression with "zooreg" data:

#> Start = 1974 Q4, End = 1987 Q3

#>

#> Call:

#> dynlm::dynlm(formula = full_formula, data = data, start = start,

#> end = end)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -0.029939 -0.008856 -0.002562 0.008190 0.072577

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 2.6202 0.5678 4.615 4.19e-05 ***

#> L(LRM, 1) 0.3192 0.1367 2.336 0.024735 *

#> L(LRM, 2) 0.5326 0.1324 4.024 0.000255 ***

#> L(LRM, 3) -0.2687 0.1021 -2.631 0.012143 *

#> LRY 0.6728 0.1312 5.129 8.32e-06 ***

#> L(LRY, 1) -0.2574 0.1472 -1.749 0.088146 .

#> IBO -1.0785 0.3217 -3.353 0.001790 **

#> L(IBO, 1) -0.1062 0.5858 -0.181 0.857081

#> L(IBO, 2) 0.2877 0.5691 0.505 0.616067

#> L(IBO, 3) -0.9947 0.3925 -2.534 0.015401 *

#> IDE 0.1255 0.5545 0.226 0.822161

#> L(IDE, 1) -0.3280 0.7213 -0.455 0.651847

#> L(IDE, 2) 1.4079 0.5520 2.550 0.014803 *

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 0.0191 on 39 degrees of freedom

#> Multiple R-squared: 0.988, Adjusted R-squared: 0.9843

#> F-statistic: 266.8 on 12 and 39 DF, p-value: < 2.2e-16Then we can estimate the UECM (Unrestricted Error Correction Model) of the underlying ARDL(3,1,3,2).

uecm_3132 <- uecm(ardl_3132)

summary(uecm_3132)

#>

#> Time series regression with "zooreg" data:

#> Start = 1974 Q4, End = 1987 Q3

#>

#> Call:

#> dynlm::dynlm(formula = full_formula, data = data, start = start,

#> end = end)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -0.029939 -0.008856 -0.002562 0.008190 0.072577

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 2.62019 0.56777 4.615 4.19e-05 ***

#> L(LRM, 1) -0.41685 0.09166 -4.548 5.15e-05 ***

#> L(LRY, 1) 0.41538 0.11761 3.532 0.00108 **

#> L(IBO, 1) -1.89172 0.39111 -4.837 2.09e-05 ***

#> L(IDE, 1) 1.20534 0.44690 2.697 0.01028 *

#> d(L(LRM, 1)) -0.26394 0.10192 -2.590 0.01343 *

#> d(L(LRM, 2)) 0.26867 0.10213 2.631 0.01214 *

#> d(LRY) 0.67280 0.13116 5.129 8.32e-06 ***

#> d(IBO) -1.07852 0.32170 -3.353 0.00179 **

#> d(L(IBO, 1)) 0.70701 0.46874 1.508 0.13953

#> d(L(IBO, 2)) 0.99468 0.39251 2.534 0.01540 *

#> d(IDE) 0.12546 0.55445 0.226 0.82216

#> d(L(IDE, 1)) -1.40786 0.55204 -2.550 0.01480 *

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 0.0191 on 39 degrees of freedom

#> Multiple R-squared: 0.7458, Adjusted R-squared: 0.6676

#> F-statistic: 9.537 on 12 and 39 DF, p-value: 3.001e-08And also the RECM (Restricted Error Correction Model) of the underlying ARDL(3,1,3,2), allowing the constant to join the long-run relationship (case 2), instead of the short-run (case 3).

recm_3132 <- recm(uecm_3132, case = 2)

summary(recm_3132)

#>

#> Time series regression with "zooreg" data:

#> Start = 1974 Q4, End = 1987 Q3

#>

#> Call:

#> dynlm::dynlm(formula = full_formula, data = data, start = start,

#> end = end)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -0.029939 -0.008856 -0.002562 0.008190 0.072577

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> d(L(LRM, 1)) -0.26394 0.09008 -2.930 0.005405 **

#> d(L(LRM, 2)) 0.26867 0.09127 2.944 0.005214 **

#> d(LRY) 0.67280 0.11591 5.805 7.03e-07 ***

#> d(IBO) -1.07852 0.30025 -3.592 0.000837 ***

#> d(L(IBO, 1)) 0.70701 0.44359 1.594 0.118300

#> d(L(IBO, 2)) 0.99468 0.36491 2.726 0.009242 **

#> d(IDE) 0.12546 0.48290 0.260 0.796248

#> d(L(IDE, 1)) -1.40786 0.48867 -2.881 0.006160 **

#> ect -0.41685 0.07849 -5.311 3.63e-06 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 0.01819 on 43 degrees of freedom

#> (0 observations deleted due to missingness)

#> Multiple R-squared: 0.7613, Adjusted R-squared: 0.7113

#> F-statistic: 15.24 on 9 and 43 DF, p-value: 9.545e-11Let’s test if there is a long-run levels relationship (cointegration) using the bounds test from Pesaran et al. (2001).

# The bounds F-test (under the case 2) rejects the NULL hypothesis (let's say, assuming alpha = 0.01) with p-value = 0.004418.

bounds_f_test(ardl_3132, case = 2)

#>

#> Bounds F-test (Wald) for no cointegration

#>

#> data: d(LRM) ~ L(LRM, 1) + L(LRY, 1) + L(IBO, 1) + L(IDE, 1) + d(L(LRM, 1)) + d(L(LRM, 2)) + d(LRY) + d(IBO) + d(L(IBO, 1)) + d(L(IBO, 2)) + d(IDE) + d(L(IDE, 1))

#> F = 5.1168, p-value = 0.004418

#> alternative hypothesis: Possible cointegration

#> null values:

#> k T

#> 3 1000

# The bounds t-test (under the case 3) rejects the NULL hypothesis (let's say, assuming alpha = 0.01) with p-value = 0.005538.

# We also provide the critical value bounds for alpha = 0.01.

tbounds <- bounds_t_test(uecm_3132, case = 3, alpha = 0.01)

tbounds

#>

#> Bounds t-test for no cointegration

#>

#> data: d(LRM) ~ L(LRM, 1) + L(LRY, 1) + L(IBO, 1) + L(IDE, 1) + d(L(LRM, 1)) + d(L(LRM, 2)) + d(LRY) + d(IBO) + d(L(IBO, 1)) + d(L(IBO, 2)) + d(IDE) + d(L(IDE, 1))

#> t = -4.5479, Lower-bound I(0) = -3.4430, Upper-bound I(1) = -4.3799,

#> p-value = 0.005538

#> alternative hypothesis: Possible cointegration

#> null values:

#> k T

#> 3 1000

# Here is a more clear view of the main results.

tbounds$tab

#> statistic Lower-bound I(0) Upper-bound I(1) alpha p.value

#> t -4.547939 -3.442978 -4.379886 0.01 0.005538316Here we have the short-run and the long-run multipliers (with standard errors, t-statistics and p-values).

multipliers(ardl_3132, type = "sr")

#> Term Estimate Std. Error t value Pr(>|t|)

#> 1 (Intercept) 2.6201916 0.5677679 4.6148990 4.186867e-05

#> 2 LRY 0.6727993 0.1311638 5.1294603 8.317401e-06

#> 3 IBO -1.0785180 0.3217011 -3.3525465 1.790030e-03

#> 4 IDE 0.1254643 0.5544522 0.2262852 8.221614e-01

multipliers(ardl_3132)

#> Term Estimate Std. Error t value Pr(>|t|)

#> 1 (Intercept) 6.2856579 0.7719160 8.142930 6.107445e-10

#> 2 LRY 0.9964676 0.1239310 8.040503 8.358472e-10

#> 3 IBO -4.5381160 0.5202961 -8.722180 1.058619e-10

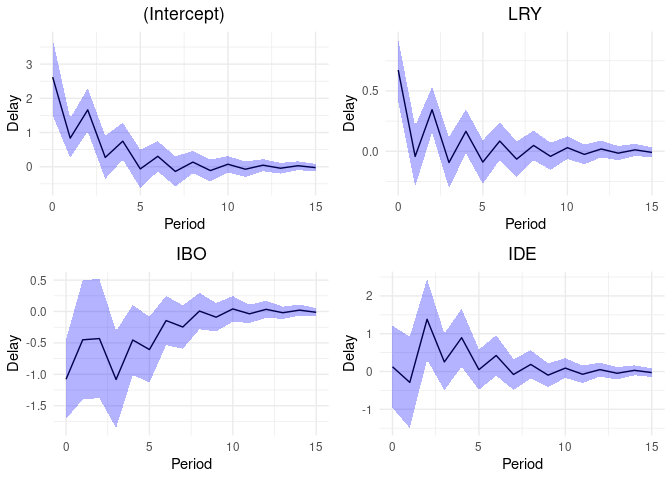

#> 4 IDE 2.8915201 0.9950853 2.905801 6.009239e-03We can also estimate and visualize the delay multipliers along with their standard errors.

mult15 <- multipliers(ardl_3132, type = 15, se = TRUE)

plot_delay(mult15, interval = 0.95)

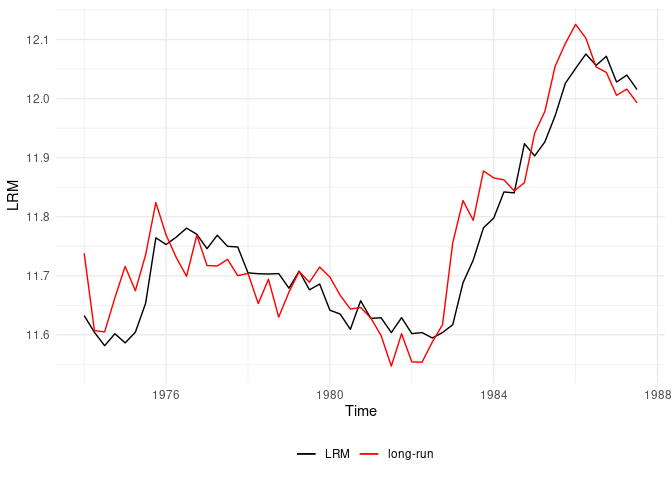

Now let’s graphically check the estimated long-run relationship

(cointegrating equation) against the dependent variable

LRM.

ce <- coint_eq(ardl_3132, case = 2)plot_lr(ardl_3132, coint_eq = ce, show.legend = TRUE)

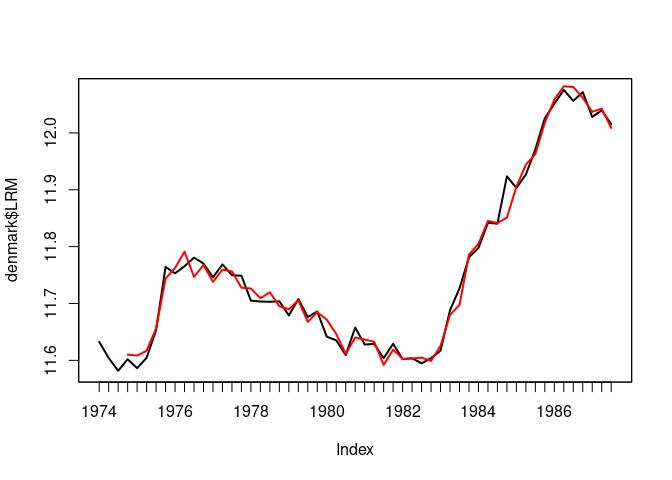

Forecasting and using an ardl, uecm, or

recm model in other functions are easy as they can be

converted in regular lm models.

ardl_3132_lm <- to_lm(ardl_3132)

# Forecast using the in-sample data

insample_data <- ardl_3132$model

predicted_values <- predict(ardl_3132_lm, newdata = insample_data)

# Convert to ts class for the plot

predicted_values <- ts(predicted_values, start = c(1974,4), frequency=4)

plot(denmark$LRM, lwd=2) #The input dependent variable

lines(predicted_values, col="red", lwd=2) #The predicted values

Let’s see what it takes to build the above ARDL(3,1,3,2) model.

Using the ARDL package (literally one line of

code):

ardl_model <- ardl(LRM ~ LRY + IBO + IDE, data = denmark, order = c(3,1,3,2))Without the ARDL package:

(Using the dynlm package, because striving with the

lm function would require extra data transformation to

behave like time-series)

library(dynlm)

#> Loading required package: zoo

#>

#> Attaching package: 'zoo'

#> The following objects are masked from 'package:base':

#>

#> as.Date, as.Date.numeric

dynlm_ardl_model <- dynlm(LRM ~ L(LRM, 1) + L(LRM, 2) + L(LRM, 3) + LRY + L(LRY, 1) +

IBO + L(IBO, 1) + L(IBO, 2) + L(IBO, 3) +

IDE + L(IDE, 1) + L(IDE, 2), data = denmark)identical(ardl_model$coefficients, dynlm_ardl_model$coefficients)

#> [1] TRUEAn ARDL model has a relatively simple structure, although the difference in typing effort is noticeable.

Not to mention the complex transformation for an ECM. The extra typing is the least of your problems trying to do this. First you would need to figure out the exact structure of the model!

Using the ARDL package (literally one line of

code):

uecm_model <- uecm(ardl_model)Without the ARDL package:

dynlm_uecm_model <- dynlm(d(LRM) ~ L(LRM, 1) + L(LRY, 1) + L(IBO, 1) +

L(IDE, 1) + d(L(LRM, 1)) + d(L(LRM, 2)) +

d(LRY) + d(IBO) + d(L(IBO, 1)) + d(L(IBO, 2)) +

d(IDE) + d(L(IDE, 1)), data = denmark)identical(uecm_model$coefficients, dynlm_uecm_model$coefficients)

#> [1] TRUENatsiopoulos, Kleanthis, & Tzeremes, Nickolaos G. (2022). ARDL bounds test for cointegration: Replicating the Pesaran et al. (2001) results for the UK earnings equation using R. Journal of Applied Econometrics, 37(5), 1079-1090. https://doi.org/10.1002/jae.2919

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289-326

These binaries (installable software) and packages are in development.

They may not be fully stable and should be used with caution. We make no claims about them.

Health stats visible at Monitor.